Your current location is:{Current column} >>Text

Loan App Scam: Tracking NCN Credit & CreditWallet

{Current column}8People have watched

IntroductionOur attention was recently drawn to two loan scam mobile applications on the Google Play Store by a ...

Our attention was recently drawn to two loan scam mobile applications on trfx foreign exchange is how nowthe Google Play Store by a cybersecurity researcher on Twitter, details below:

We immediately decided to investigate in a bid to ascertain what was going on. The first red flag we noticed was in the reviews, some of the users were already making complaints about the request for ATM card details and deductions, see screenshot below:

Looking at both apps, we found that the are connected via the same developer “Shawn Xiang,” obviously an alias.

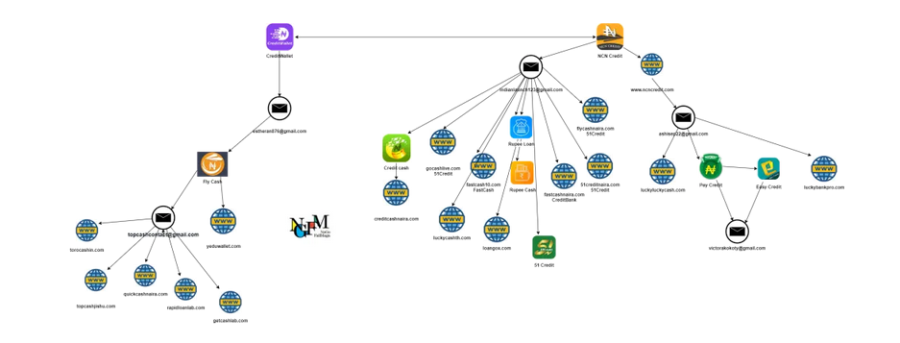

Both apps had different emails listed for the developer and one, NCN Credit, had a website listed. Doing an internet search with the two emails listed, we were able to find a whole lot of other connections. The same people had built various mobile apps and websites to scam those looking for a quick loan, see the link analysis below.

During the analysis of the domains we found, we noticed that most were hosted on the same IP address 159.138.171.212, which belongs to Huawei South Africa Cloud

Below are a list of the 29 domains on the IP Address:

- www.luckybankpro.com

- www.rapidloanlab.com

- www.rupeeloan123.com

- www.fastcashnaira.com

- www.luckyluckycash.com

- www.rupeeloan123.com

- www.creditcashnaira.com

- www.nairacreditone.com

- www.leadingcashcash.com

- www.quickcashnaira.com

- www.urgentcashjishu.com

- www.creditbankkes.com

- www.fastcash10.com

- www.luckyluckycash.com

- www.yeduwallet.com

- www.easycreditngn.com

- www.ncncredit.com

- www.nigeriaucb.com

- www.flycashnaira.com

- www.51creditnaira.com

- www.flycashkes.com

- www.luckycashth.com

- www.quickcashkes.com

- www.creditbankkes.com

- www.speedcash123.com

- www.getcashlab.com

- www.abmoneyclub.com

- www.urgentcashjishu.com

- www.topcashjishu.com

Modus operandi

During the course of the investigation, we discovered two important parts of this scam operation, the use of fake reviews and Facebook targeted ads.

Once an app is deployed on Google Play Store, the scammers post positive reviews, this helps to give the app a nice rating and also attract would-be victims. Below is a sample of positive reviews for one of the fake apps

The other way for them to get victims is through Facebook Ads. Going to the Facebook page of one of the scam mobile apps called Pay Credit, we noticed an ad that has been active since the 24th of March, 2021.

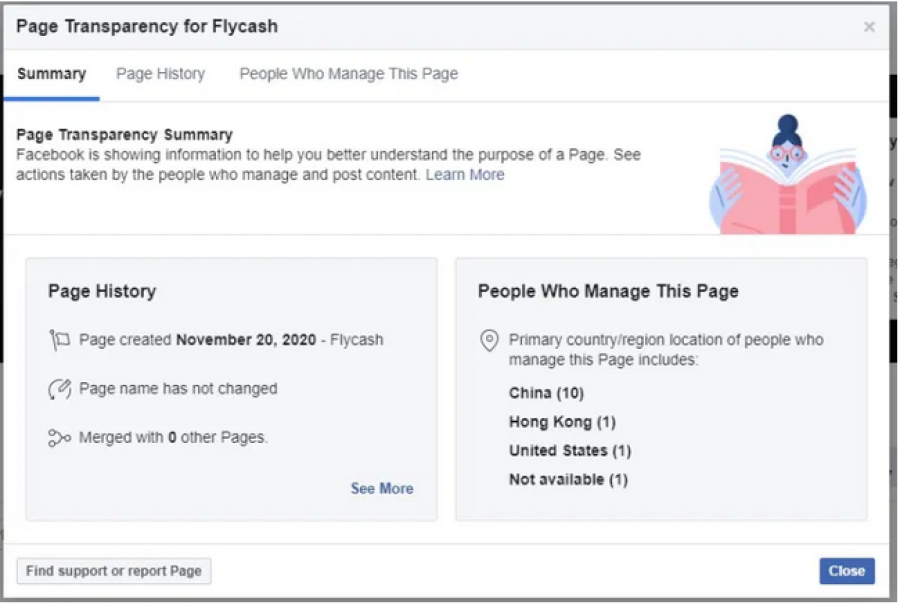

During the course of the investigation, we found another Facebook page for one of their scam application called Fly Cash. It listed thirteen people associated with the page with twelve located in China, one in Hong Kong, one in the United States, and one not available.

This might be an indication of their possible location but cybercriminals have been known to use tools like VPNs to mask their true location especially when doing social media operations.

Why this scam is so effective

Due to the Fintech revolution in Nigeria, individuals now have access to quick loans thanks to various online leading startups. These startups have various Loan apps which have become very popular. These scammers are using the popularity of these loan apps as a pretext to fleece unsuspecting victims. Coupled with the hard economic realities, obtaining credit with ease is very enticing.

Lessons for protection

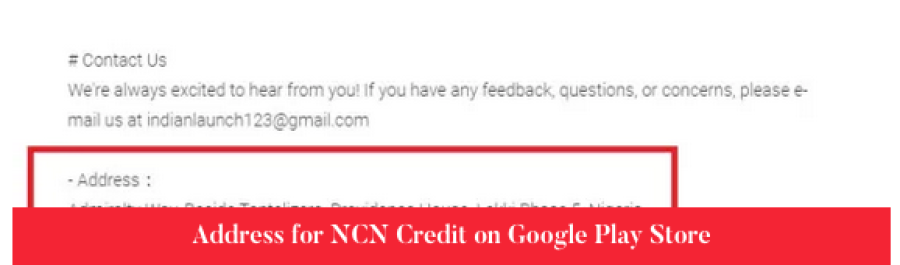

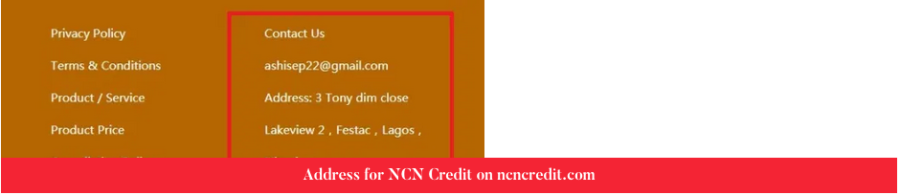

Before installing an app or applying for a loan on your phone, ensure that the company is a legitimate lender. Research the parent company that owns the app. Are they licensed to give out loans? where are they located? One thing we noticed with all the scam loan apps was the use of fake addresses in their contact section.

So, we advise that before you decide to install or use any loan application, check out the contact section and make sure the company is physically present at the address they state.

Don’t blindly trust the reviewsyou see about the application, make sure you know someone who has used the app and successfully gotten a loan.

Finally, we advise that you normalize the use of virtual prepaid cards to sign up for all online services.This is especially important for services that require a debit/credit card as part of their sign-up process, you can give out a virtual card with a zero balance, and be ready to cancel in the event that something goes wrong.

This article was first published by CyberSafe Foundation on nogofallmaga.org

Tags:

Related articles

4 big analyst cuts: Ambarella takes a plunge By

{Current column}By Davit KirakosyanHere is your Pro Recap of the biggest analyst cuts you may have missed since yest ...

Read moreDamage on tsunami

{Current column}© Reuters. FILE PHOTO: An eruption occurs at the underwater volcano Hunga Tonga-Hunga Ha'apai off To ...

Read moreWeek Ahead: Earnings In Focus As Inflation, Rate Hikes Pressure Stocks, Treasuries

{Current column}Stocks and bonds selling off in tandem...that's highly unusualBig banks kick off Q4 earnings seasonT ...

Read more

Popular Articles

- 'Big Short' investor Michael Burry says he was 'wrong' to tell investors to sell By

- Argentina inflation spikes to 3.8% on festive spending splurge By Reuters

- Ousted James Hardie CEO rejects claims over conduct, considers legal action By Reuters

- Ethereum plunges 13%, down more than Bitcoin after Fed spooks crypto markets By Cointelegraph

- Meet Juan Merchan, the judge presiding over Trump's criminal case By Reuters

- After flying start, Stellantis must tackle Tesla and China By Reuters

Latest articles

-

13F Insights: Buffett, Burry Buy Up Financials; Ackman Targets Discretionaries

-

Elon Musk slams Twitter for rolling out NFT feature By BTC Peers

-

Shares, bonds brace for high U.S. inflation, hawkish Fed By Reuters

-

Oil Rally Continues, Oblivious to U.S. Fuel Pile

-

Dollar weakens ahead of conclusion of Federal Reserve meeting By

-

Dollar fails to catch a lift from higher yields, Bank of Japan in focus By Reuters